Volatile markets such as cryptocurrency markets are prone to excesses on the upside and the downside. Investors are rarely concerned with the upside events, but the downside events receive tremendous attention. As we see this week with television pundits and social media commentators weighing in on where the bottom may be and attempting to identify the exact date of reversal. Many of these commentators are calling the events of May 2022 a capitulation, but is it?

Market capitulation is the notion that a market reaches such bearish excesses that there are no more sellers in the market and the market is likely to reverse direction quickly and drastically. Note that this is more than simply a local reversal bottom in the market, a capitulation signifies an inflection point in the market cycle as investors can no longer stomach the losses and sell out of their positions en masse. For better or worse, there have been numerous capitulation events in the history of the cryptocurrency market and Bitcoin as the cryptocurrency with the longest history is most instructive.

History of Capitulation Events

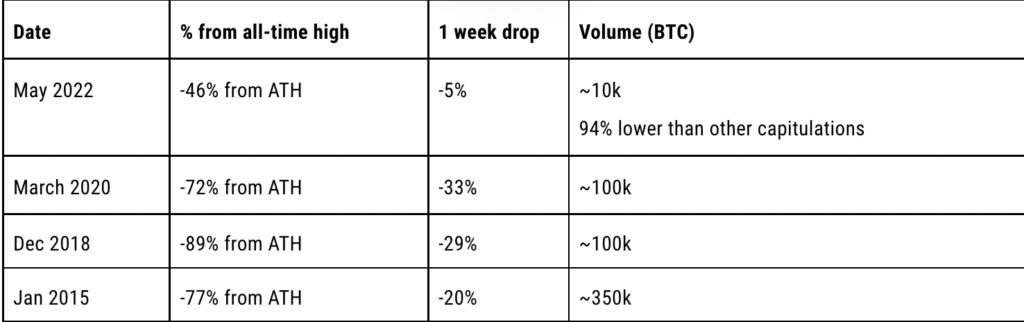

When attempting to spot capitulation events, we must look for more than a one day drop and seek context from the history of the asset class to inform our investment strategies. There have been three major capitulation events during the recent history of Bitcoin. How does the recent drop in May 2022 compare?

January 2015 is the least like the others because Bitcoin had not reached popular consciousness yet, so focus on December 2018, which was the capitulation ending the bear market of 2017-2018 and May 2022, which coincided with the broader COVID market crash.

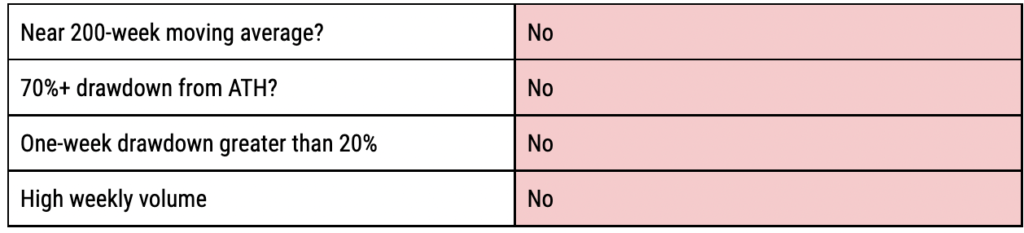

These events all have a number of things in common:

- The capitulation event occurs near the 200-week moving average

- The drawdown from the all-time high is greater than 70%

- The one-week drawdown is greater than 20%

- The weekly volume is extremely high

How does that compare with May 2022?

Market pundits and social media commentators may continue to refer to the price action of May 2022 as a capitulation event, but it does not match up with the others historically. That does not mean that May 2022 will not be a reversal point where upward pressure could occur, only that it is not a capitulation in the long-term perspective.

GENERAL DISCLAIMER

This presentation is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. Securities of TrueCode Capital Crypto Momentum Fund LP (the “Fund”) managed by TrueCode Capital LLC (the “General Partner”) are offered to selected investors only by means of a complete offering memorandum and related subscription materials which contain significant additional information about the terms of an investment in the Fund (such documents, the “Offering Documents”). Any decision to invest must be based solely upon the information set forth in the Offering Documents, regardless of any information investors may have been otherwise furnished, including this presentation. The information in this presentation was prepared by the General Partner and is believed by the General Partner to be reliable and has been obtained from public sources believed to be reliable. General Partner makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this presentation constitute the current judgment of the General Partner and are subject to change without notice. Any projections, forecasts and estimates contained in this presentation are necessarily speculative in nature and are based upon certain assumptions. It can be expected that some or all of such assumptions will not materialize or will vary significantly from actual results. Accordingly, any projections are only estimates and actual results will differ and may vary substantially from the projections or estimates shown. This presentation is not intended as a recommendation to purchase or sell any commodity or security. The General Partner has no obligation to update, modify or amend this presentation or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, project on, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

Disclosure #1:

Certain scenarios described herein are for illustrative purposes only and the assets described are not actual assets held by the Fund. These scenarios show the Principal’s investment in the Incubator Account. Inclusion of such scenarios is not intended as a recommendation to purchase or sell any assets and performance of the Incubator Account in these scenarios does not guarantee that the Fund will experience similar investment results or earn any money whatsoever.

Disclosure #2:

Any projections, forecasts and estimates contained in this document are necessarily speculative in nature and are based upon certain assumptions. In addition, matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond the Fund’s control. No representations or warranties are made as to the accuracy of such forward-looking statements. It can be expected that some or all of such forward-looking assumptions will not materialize or will vary significantly from actual results. Accordingly, any projections are only estimates and actual results will differ and may vary substantially from the projections or estimates shown.

Disclosure #3:

The graphs, charts and other visual aids are provided for informational purposes only. None of these graphs, charts or visual aids can and of themselves be used to make investment decisions. No representation is made that these will assist any person in making investment decisions and no graph, chart or other visual aid can capture all factors and variables required in making such decisions.

Disclosure #4:

The summary provided herein of the Fund’s terms and conditions does not purport to be complete. The Fund’s Memorandum should be read in its entirety prior to an investment in the Fund.