Join Joshua Peck, Chief Investment Officer at TrueCode Capital, as he explores the groundbreaking world of cryptocurrency investment. From his early investments in Bitcoin to pioneering a sophisticated approach to digital asset management, Joshua’s journey is a testament to the potential of cryptocurrencies. TrueCode Capital merges cutting-edge technology with deep market insights to navigate the volatile cryptocurrency landscape effectively.

Drop me your email at [email protected] and I’ll give you a Kindle version of the book when it is ready.

Explore the unique investment opportunities with TrueCode Capital’s managed fund in our upcoming call. Led by Joshua Peck, gain insights into the strategies that drive success in digital asset markets. Join us to learn how you can be part of this exclusive investing journey.

Drop me your email at [email protected] and I’ll give you a Kindle version of the book when it is ready.

Unlock the secrets of crypto investing in 2024! Join Joshua Peck of TrueCode Capital in our exclusive webinar to navigate the future of digital assets with confidence. Don’t miss this chance to transform your crypto strategy with insights from a leading industry expert. Register now for ‘Crypto Investment Playbook: Preparing for 2024’ and stay ahead in the dynamic world of cryptocurrency!

Drop me your email at [email protected] and I’ll give you a Kindle version of the book when it is ready.

Explore the unique investment opportunities with TrueCode Capital’s managed fund in our upcoming call. Led by Joshua Peck, gain insights into the strategies that drive success in digital asset markets. Join us to learn how you can be part of this exclusive investing journey.

Drop me your email at [email protected] and I’ll give you a Kindle version of the book when it is ready.

Join us for an in-depth exploration tailored for the sophisticated investor. Dive into the cryptocurrency world, where the digital future meets tangible assets. High net worth individuals often find themselves navigating a unique set of challenges when entering the crypto space, primarily when it concerns managing and storing substantial amounts of digital assets.

Drop me your email at [email protected] and I’ll give you a Kindle version of the book when it is ready.

The exclusive event featuring Joshua Peck, the founder of TrueCode Capital and the bestselling author of “Cryptocurrency Risk Management: A Guide for Family Wealth Managers,” seems like a promising opportunity for individuals interested in cryptocurrency investments. Joshua’s expertise in the field of cryptocurrency risk management and allocation can provide valuable insights for investors.

Drop me your email at [email protected] and I’ll give you a Kindle version of the book when it is ready.

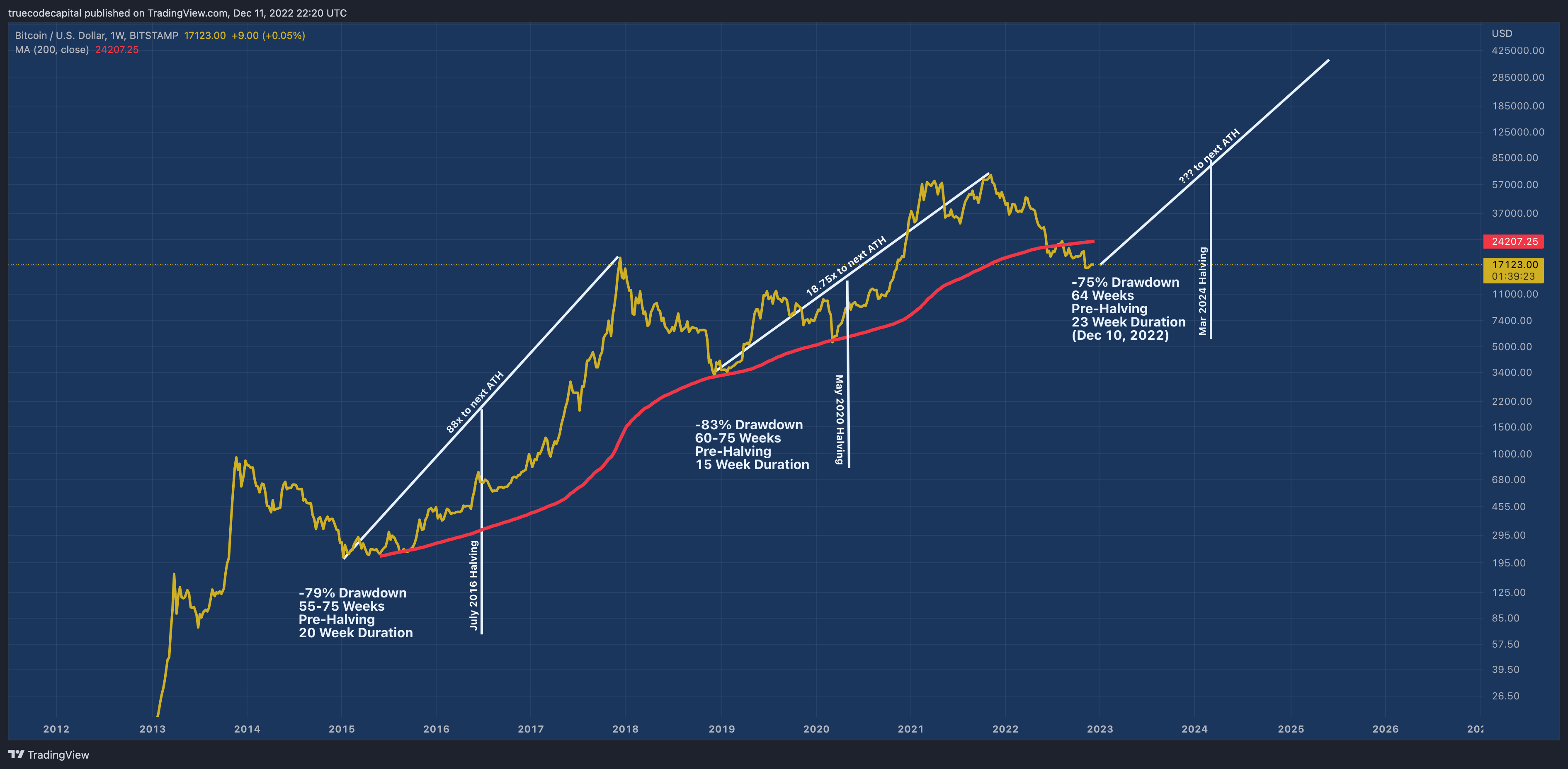

In this highly insightful video, Joshua Peck, the CEO of TrueCode Capital, a leading crypto hedge fund, sheds light on the intriguing dynamics of the Bitcoin halving cycle and its substantial impact on the crypto market.

Drop me your email at [email protected] and I’ll give you a Kindle version of the book when it is ready.

Welcome to TrueCode Capital’s Monthly Crypto Market Update with Joshua Peck, the CIO of TrueCode Capital. In this video, Joshua Peck provides valuable insights into the current state of the crypto market and discusses the recent shocking news regarding the SEC’s lawsuit against Binance, one of the largest crypto exchanges.

Drop me your email at [email protected] and I’ll give you a Kindle version of the book when it is ready.

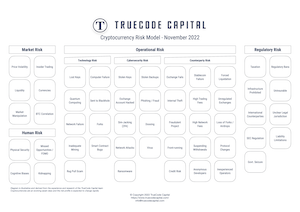

The year 2022 has brought so much big news from the crypto world that it may have caused a shock to the world of crypto investing. In this video, let’s dive deep into the trends and big news that happened in 2022 in order for us to understand what will happen to the crypto market in 2023. I will share tips to help you make better investment decisions and take risk management more seriously.

Drop me your email at [email protected] and I’ll give you a Kindle version of the book when it is ready.

FTX, a Bahamas-based cryptocurrency exchange, has filed for bankruptcy. In this video, Joshua Peck helps us to learn about the factors that lead to this bankruptcy, what we can expect from FTX in the future, and what we can learn from this event to make us more informed and smart traders and investors.

Drop me your email at [email protected] and I’ll give you a Kindle version of the book when it is ready.

Everyone is focused on how to avoid losing money while crypto investing after the failure of FTX, the third-largest crypto exchange in the world. In my book, Cryptocurrency Risk Management: A guide for family wealth managers, I explore this topic in depth and provide a checklist of questions to ask of any asset manager selling a crypto investment or of yourself if you are managing your portfolio directly.

Drop me your email at [email protected] and I’ll give you a Kindle version of the book when it is ready.

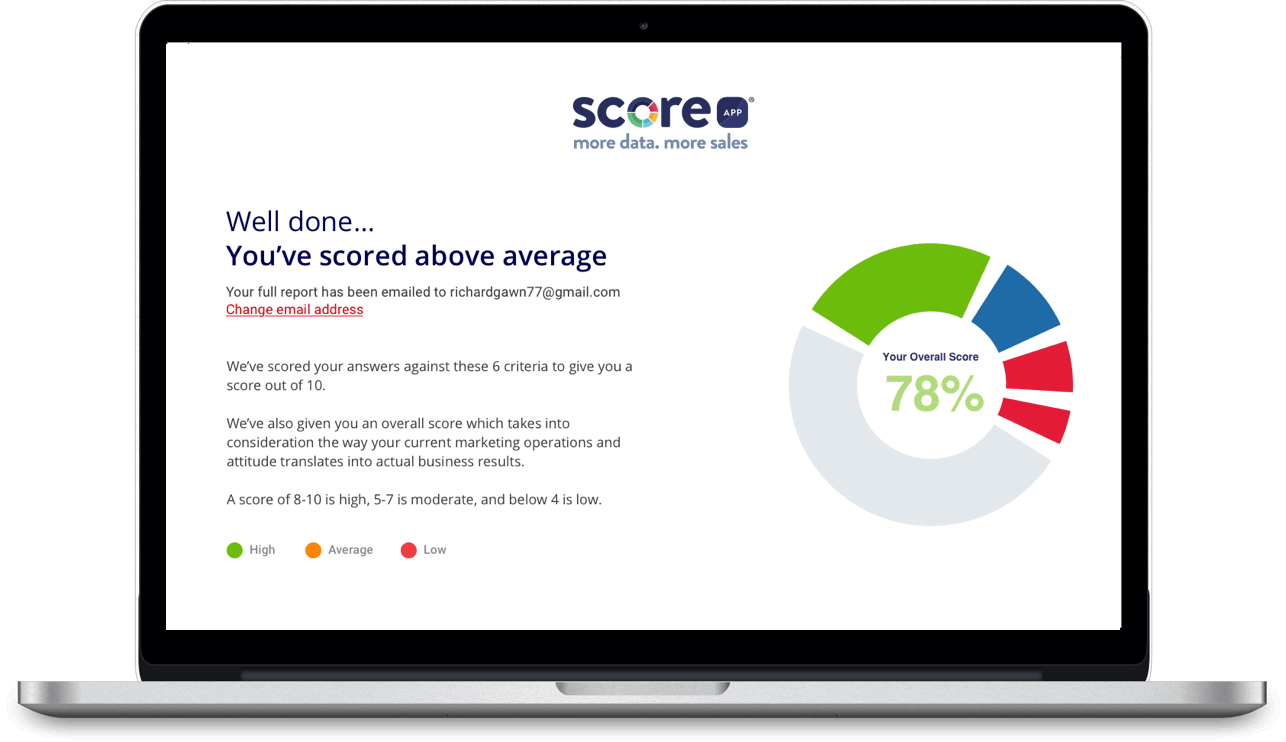

Answer 12 questions on a scale of 1-10 to see how you can become a confident crypto investor.

A cryptocurrency investment can be lucrative or devastating depending on how you manage it. Do you have the knowledge to plan an execute a crypto strategy that creates or sustains generational wealth?

Take the quize and receive a 15-page PDF report dissecting your results.

Bitcoin halving is a predetermined event that occurs roughly every four years and reduces the number of new bitcoins created and released into circulation by 50%. This event is programmed into Bitcoin’s code and is an essential part of the cryptocurrency’s design. The purpose of the halving is to control the supply of bitcoins and prevent inflation, as the total number of bitcoins that can ever be created is limited to 21 million. Each halving brings the number of new Bitcoins released with each block reward closer to the total cap, making it increasingly difficult and expensive to create new coins. This event is widely anticipated by the Bitcoin community as it can have a significant impact on the price of Bitcoin.

Drop me your email at [email protected] and I’ll give you a Kindle version of the book when it is ready.

Drop me your email at [email protected] and I’ll give you a Kindle version of the book when it is ready.